If it blows from the south west though I have no problems. Go figure.

I'm talking about the original frame house on our property which we'll be tearing down this spring. The old girl was in bad shape when we bought this property four years ago, which is why the decision to build a new home out of a recycled grain bin, was a no brainer.

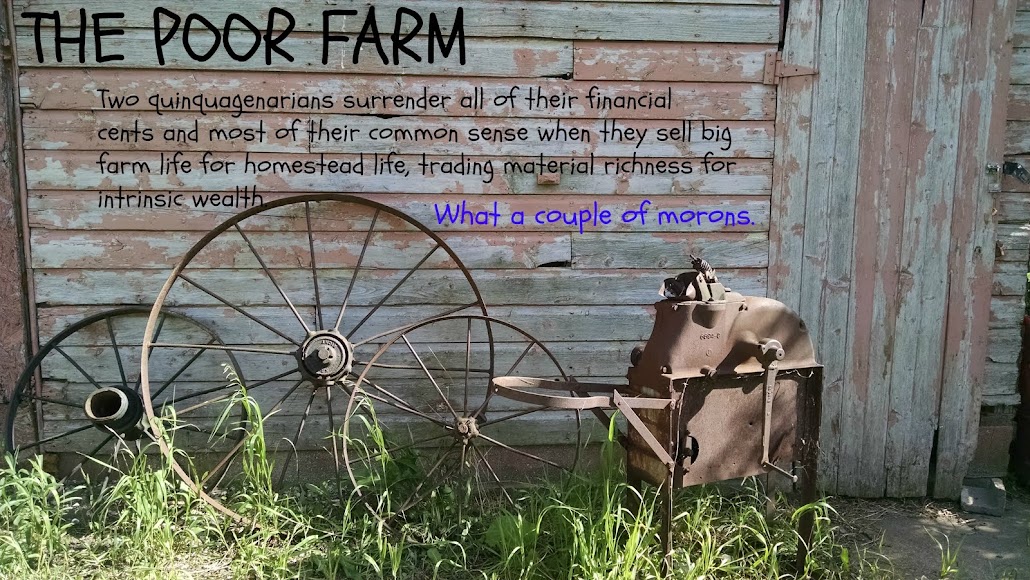

Here's the old girl herself, built in 1856 and home to several families over the decades.

She's covered with cheap vinyl on the outside and had two porches added on in her later years. The roofs over the porches was of poor quality so now both of them are leaking and the floors in them are giving way. Getting in and out of this place gets a bit dicey at times.

We also used the old kitchen to store our freezers where we keep all the meat we raise here for our own good eating. After the barn is built these will move into our new barn in a separate storage room.

The main portions of the house, the kitchen, living room and downstairs bedroom plus three bedrooms upstairs have remained dry. Thank good ness because we used those rooms to store furniture we still need to sell and/or give away, plus building materials for the rest of the farm, and canning supplies. These items too, will have a new home in the barn when it's done.

The upstairs of the house is cramped and dark. A recently added hall closet-"recently" being in the last 30 years or so-revealed many usable 2x4's Keith will recycle into the barn build.

Because every haunted house needs an EXIT sign don't you think?

Hardware from the mid 19th century.

Wallpaper in one of the upstairs bedrooms. Good to know we have patriotic spirits about us.

This is what happens when you move from a 3000 SF farm house into an itty bitty Looney Bin

We will pile up debris outside the house as we go this summer, and then rent a large dumpster to haul it all away. I am hopeful we will find some old newspapers, other treasures when we start pulling apart the walls.

The area where this house now stands will be an open park like zone between our grain bin home and the barn, perfect for flower gardens, outdoor seating etc...It will be frustrating to make more messes here on The Poor Farm, but in the end, we'll have a pretty little homestead.

I figure if I keep saying that over and over it might come true.